This Week in Refinement

How systems are built.

For the first time, we’ll give you a complete introduction to the philosophy of living and acting in a conscious, elegant, and effective way (at the very end). We’ll also tell you about a man who, at just 24, was doing business with European banks.

Refined Perspectives

What did we learn?

That stepping out of your comfort zone always pays off.

That even an introvert can lift the whole world.

That knowledge and constant learning are the real capital.

Mind Behind the Brand

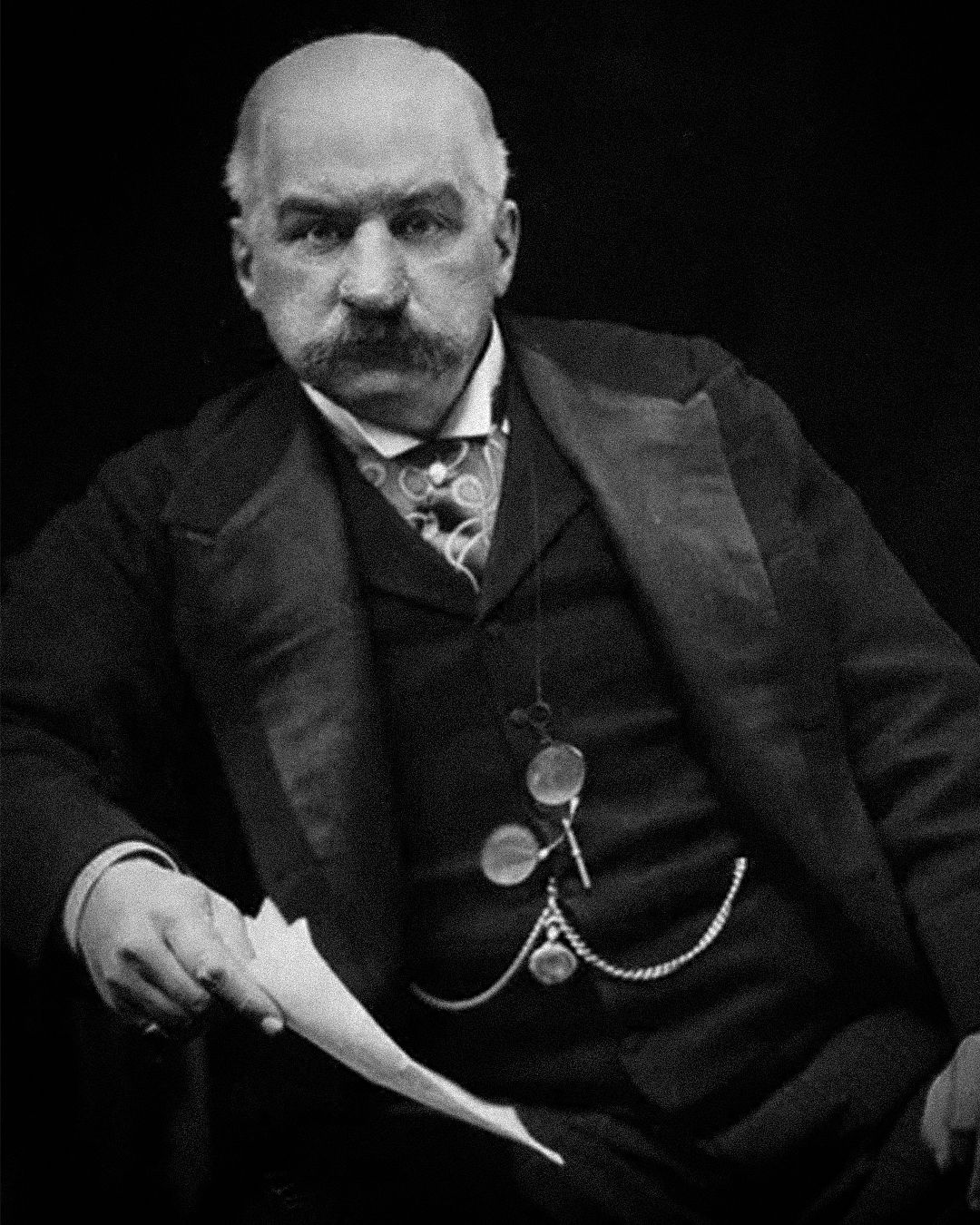

John Pierpont Morgan

The J.P. Morgan Bank was founded by a man who looked as if he had been born in a suit.

John Pierpont Morgan, known simply as J.P. Morgan, was something between a financier, an engineer, and an empire strategist.

He built a bank that, in the 19th century, financed entire sectors of industry such as steel, railroads, and energy. In essence, it acted as a private central bank of the United States before the nation even had one.

He saved the American financial system during the Panic of 1907, using his own money to stabilize the market. One man did what today would require the agreement of twenty institutions and a decade and a half of bureaucracy.

If you have to ask how much it costs, you can't afford it.

Refined Rewind

A shy boy.

Born into wealth and raised with strict discipline, he grew up between America and Europe, where he studied finance as if it were a form of warfare.

By the age of 30, he had more influence than most governments. By 40, he controlled railroads, steel, and the electric industry, effectively steering the U.S. economy from behind his desk.

He was the one who merged the companies that created General Electric and U.S. Steel, the first corporation in history worth over one billion dollars.

J.P. Morgan was obsessively shy and had a large tumor on his nose that he refused to have removed. He avoided cameras, portraits, and public appearances because he hated how he looked. Yet he was a man who could stop the entire market with a single telegram.

He collected rare manuscripts, art, and first editions of books. His private library was so vast that, after his death, it became the foundation of New York’s Morgan Library & Museum.

And he lived by one guiding belief: “People don’t buy what you sell, they buy what you believe.” It sounds like something a 21st-century copywriter would write, but it was his approach to managing capital 150 years ago.

Refined Lessons

What does his story teach us?

Stability must be forced

Morgan despised chaos. In his world, order reigned, and predictability was a form of dominance. He didn’t wait for the market to calm down — he created the rules the market had to follow. The truth is, if you don’t build your own system, you’ll end up as a cog in someone else’s.

Control the board

While others fought for contracts, Morgan built entire industries. He was the architect of structures that decided who earned and who didn’t. Stop reacting to trends. Build an ecosystem that forces others to react to you.

Knowledge is the true capital

Morgan invested in his library before he invested in steel. He understood that intelligence is the only currency that never loses value in a crisis. Your brand might fall, your account might hit zero, but if you understand how the system works — you can build it again from scratch.

Join the Movement

Stay refined.

We’ve prepared something special for you, not a guide on “how to build a business,”

but a manifesto that shows how your daily life, decisions, and rituals can become tools of power, value, and authority in both work and personal life.

That’s all for this week.

Thank you for reading and for downloading our free guide.

Wishing you all the best and a productive week ahead.

Michał, Refined Money.

P.S. If you haven’t read previous editions of the newsletter, visit our website to see all past emails.